Whichever route you decide to go, you will need to confirm that the option you choose is recognized by all the states in which you intend to operate. If you are going to be working alone, without partners, I see few benefits to establishing a PC as opposed to an LLC. The default, however, is that PCs are required to file their own tax returns and be subject to corporate tax rates, which are notoriously high.

PCs can also be set up as pass-through entities. All that is required is an extra attachment to your personal tax returns. Creating a single member LLC will have a minimal impact on your taxes.

When choosing between a PC and an LLC, the determining factor may be how you want to handle your taxes. For instance, if you get into a dispute with your landlord, your liability to your landlord might be limited. And a limited liability company will limit your liability from other sources of risk.

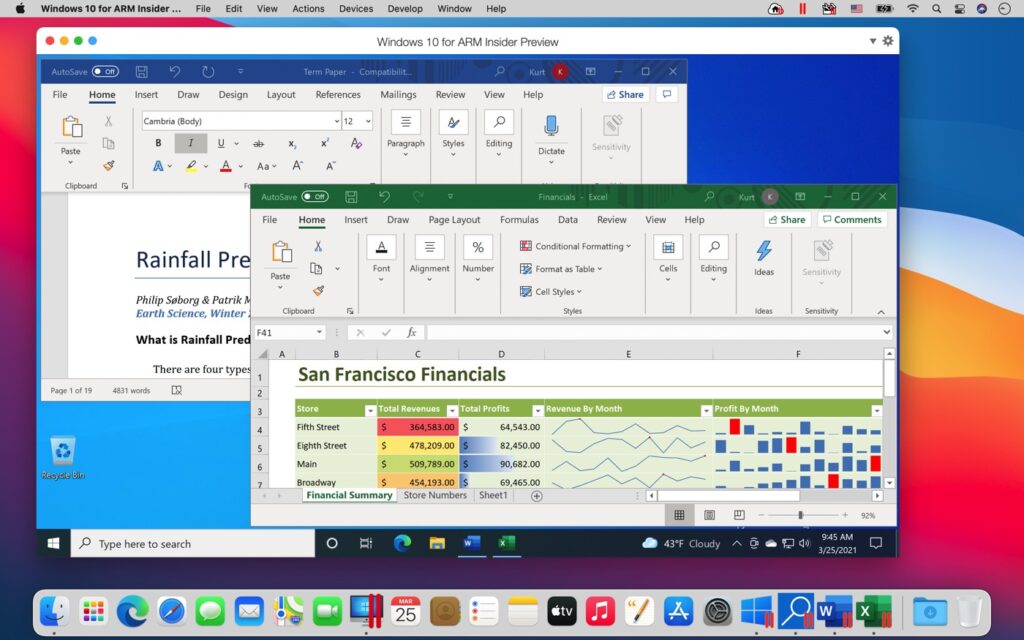

Mac or pc for law office professional#

A professional corporation, however, will protect you from liability for the malpractice of your partners, if you have them. For professionals, however, this liability limitation does not extend to our biggest risk - being sued by a client or patient for malpractice. Factors to consider when choosing between a PC and an LLCĪ professional corporation and a limited liability company both offer their owners the benefit of limited liability in the event that an activity of the business harms someone. But having just been through this myself, I know that choosing between a PC and an LLC as your business form can be confusing. Better options exist for small business professional service providers, most notably the professional corporation and the limited liability company. But those tend to be expensive and to require too many formalities for small operations. There are the well-known traditional options, such as incorporating. If you are a lawyer, doctor, or accountant starting your own practice, one of the earliest decisions you will need to make is the type of business entity you would like to form.

0 kommentar(er)

0 kommentar(er)